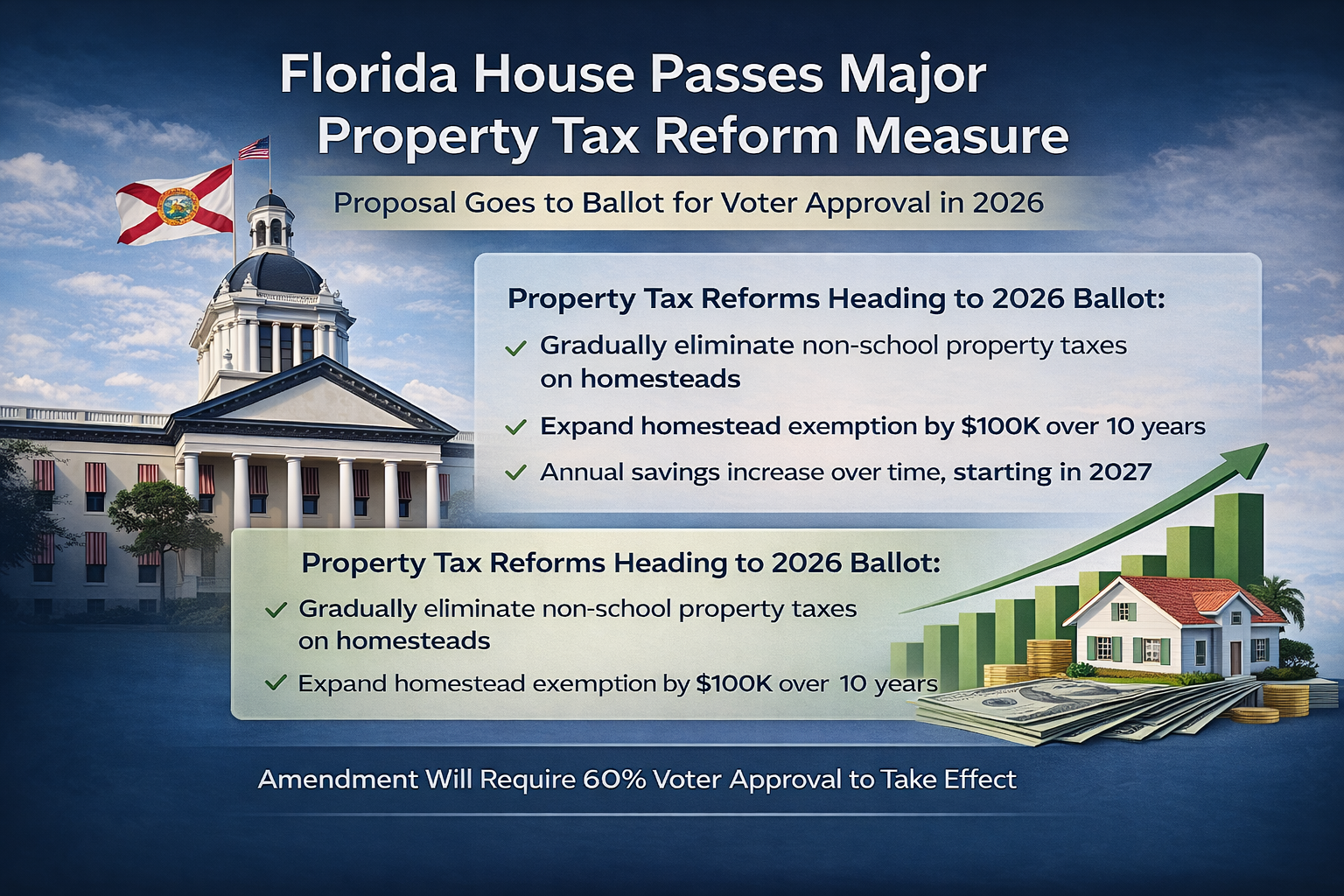

Florida House Approves Major Property Tax Reform Proposal Heading to Voters in 2026

The Florida House of Representatives has just passed a significant property tax reform proposal that could reshape how homeowners are taxed across the state. The bill, approved on Feb. 19, 2026, sends a proposed constitutional amendment to the ballot that would eliminate non-school property taxes on homesteaded homes and expand homestead tax exemptions — a development that could deliver meaningful tax relief for many Florida homeowners.

What Was Just Approved?

The House passed House Joint Resolution 203 (HJR 203), which would place a constitutional amendment before Florida voters this November. If approved by at least 60% of voters (a requirement for constitutional changes in Florida), the amendment would:

- Increase the homestead exemption for non-school property taxes by $100,000 per year over 10 years beginning in 2027.

- Eventually eliminate non-school property taxes on homesteaded homes starting in 2037.

- Maintain property tax levies for schools, which are not impacted by this amendment.

In plain terms, the measure seeks to put more money back into the pockets of Florida homeowners by gradually reducing the tax burden on primary residences.

Why This Matters to Florida Homeowners

Property taxes are a major financial component of homeownership in Florida. They fund vital local services including:

- Public schools

- Fire and police departments

- Infrastructure and road maintenance

- Local government operations

Eliminating or reducing non-school property taxes could significantly lower tax bills for many homeowners — particularly those on fixed incomes or long-term homesteads.

However, this change is not yet law. First, it must be approved by Florida voters on the November 2026 ballot. Only if at least 60% of ballot participants vote “yes” would the amendment take effect.

Where the Proposal Stands Politically

While the House approved the resolution in a decisive vote, the proposal now faces several hurdles:

- Uncertain Senate support: Senate leadership has not committed to moving the measure forward, meaning negotiations are likely in the final weeks of session.

- Governor’s position: Governor Ron DeSantis has expressed support for meaningful property tax relief but has also suggested a different or more comprehensive approach, indicating he may work with the Senate on a separate plan.

How This Could Affect You

If this amendment becomes law:

- Homestead property tax bills could decline annually as exemptions expand.

- Local governments may need to adjust budgets or identify alternate revenue sources, since property tax revenue funds essential services.

- Homeowner affordability could improve, especially for new and long-time owners alike.

For current homeowners and prospective buyers, this development underscores the importance of staying informed about policy changes that directly impact long-term housing costs.

What’s Next

The proposed amendment will be debated in the Florida Senate. If it survives that legislative hurdle, it will go before voters in November 2026. Homeowners, buyers, and real estate professionals should continue monitoring both legislative and ballot progress, as the ultimate impact will hinge on voter approval in the fall.

Leave a Reply