Many first-time homebuyers in Volusia County are currently sitting on the sidelines, waiting for that magical moment when mortgage rates dip back into the 5s. Psychologically, it feels like the smart financial move. But running the actual numbers reveals a surprising truth about what a “lower rate” really saves you in our local market.

Let’s break down exactly what waiting for a sub-6% interest rate actually changes—and why holding out for a house in Daytona Beach or Holly Hill might end up costing you more.

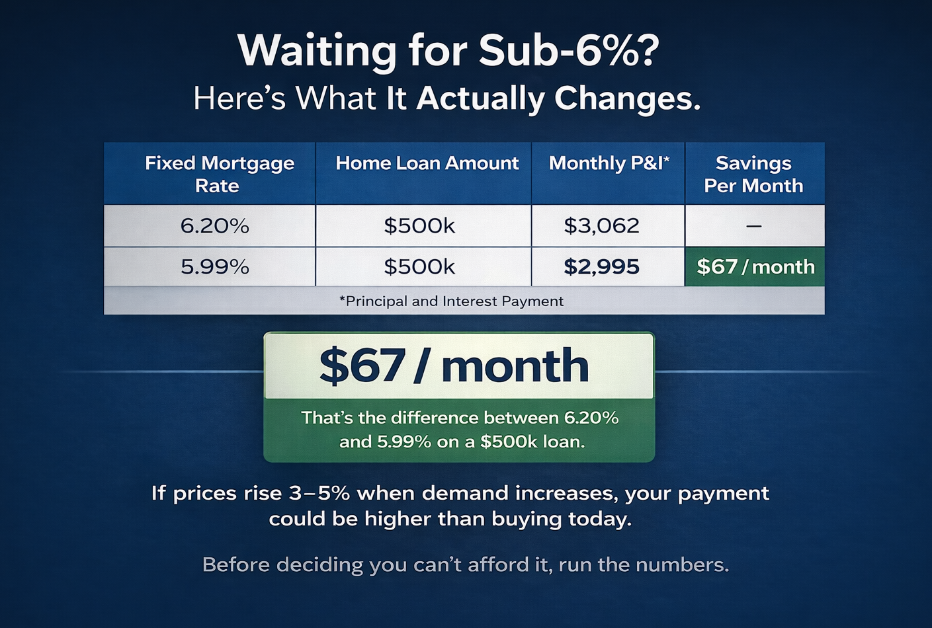

The $67 Illusion: Running the Numbers

To understand the real impact of a rate drop, let’s look at a standard $500,000 home loan. Here is how a drop from the low 6s into the high 5s impacts your monthly Principal and Interest (P&I) payment:

- At a 6.20% Fixed Rate: Your monthly P&I is $3,062.

- At a 5.99% Fixed Rate: Your monthly P&I drops to $2,995.

The difference? Just $67 a month.

While keeping an extra $67 in your pocket is always nice, it is a relatively small difference when looking at the overall cost of homeownership in Florida.

The Real Risk: Surging Buyer Demand in Volusia County

Here is the hidden trap of waiting for rates to drop: you are not the only one waiting. When interest rates fall below that psychological 6% threshold, a massive wave of pent-up buyer demand will re-enter the market.

Currently, local market data shows that single-family home prices in Volusia County are cooling from recent peaks, reflecting a healthier, more balanced market rather than a downturn. Homes are taking a bit longer to sell, giving buyers more time and leverage. However, Florida is already showing early signs of a shift, with buyer activity rebounding.

When lower rates cause demand to spike further, home prices rise. If increased competition pushes home prices up by just 3% to 5%, that same $500,000 house suddenly costs $515,000 to $525,000.

- You might secure that shiny 5.99% rate, but you’ll be applying it to a significantly larger loan amount.

- Because you are financing a higher purchase price, your monthly payment could actually be higher than if you had simply bought today at 6.20%.

What This Means for the Daytona Beach Market

In competitive coastal markets like Daytona Beach, Ormond Beach, and the surrounding Holly Hill area, waiting on the sidelines can mean missing out on the right property altogether. Getting your foot in the door and starting to build equity often outweighs the minimal monthly savings of a slightly lower rate.

As the old real estate saying goes: Date the rate, marry the house. If rates drop significantly in the future, you always have the option to refinance. But you cannot retroactively buy a house at today’s prices or in today’s balanced market conditions.

The Bottom Line for Florida Buyers

Before deciding you can’t afford to buy right now, sit down and run the numbers. Making a massive financial decision based on national headlines rather than your own personal math can be an expensive mistake.

If you are a first-time homebuyer looking to navigate the 2026 Daytona Beach real estate market, let’s connect. As your local eXp Realty expert, I can help you find a home that fits your budget today, before the next wave of buyers drives prices up.